Trading is a challenging profession that requires making decisions based on imperfect information. We’ve all experienced the frustration of exiting a trade only to see the market move in our favor immediately afterward. At times, we exit at our target as planned, only to see the stock soar even higher. In these moments, it’s easy to fall into a spiral of regret and self-doubt. However, it’s important to remember that trading decisions are based on available information, and hindsight is always clearer.

We often find ourselves second-guessing our trading decisions, especially when they don’t turn out as we hoped. These moments led me to reflect on the nature of trading decisions and the need to make peace with them. This post presents my view of understanding and accepting the unpredictability of the market. The aim is to empower you to embrace your decisions by highlighting the fact that regret is an emotion traders must experience and master in their journey.

What is Trader’s Regret ?

Trader’s regret is the feeling of remorse after we make a decision that results in a loss or missed opportunity. This can lead to negative emotions, such as frustration, self-doubt, and fear, which can impact future trading decisions. It is a common psychological challenge that traders face.

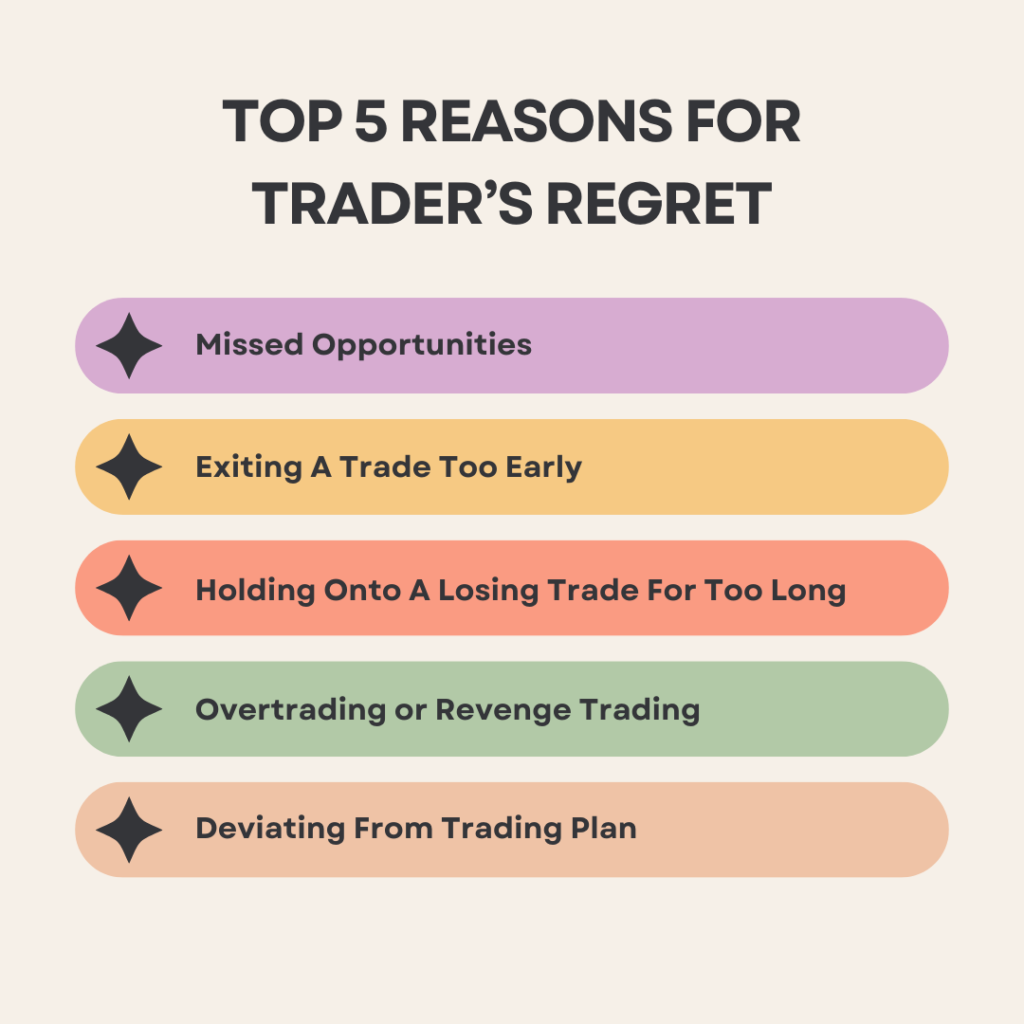

Top 5 Situations That Lead To Regret In Your Trading Decisions

Trader’s regret can stem from a variety of scenarios and circumstances. The top 6 are :

- Missed Opportunities: Not taking a trade that would have been profitable. Could be due to lack of preparation or non-availability during trading hours. It could also be due to past fear holding you back.

- Exiting a trade too early, especially if the market moves significantly in our favour after exit.

- We may regret holding onto losing trades for too long, hoping for a turnaround that never comes.

- Overtrading / Revenge Trading when it leads to losses. It is a fact that those losses could have been avoided if we had been patient and calm.

- Violating Trading Rules: Deviating from our trading plan or rules, funnily, only when it ends in losses.

Trader’s regret can manifest in situations where we believe we could have made a better decision in hindsight.

How to escape trader’s regret & make peace with your trading decisions?

Accepting Imperfection In Your Trading Decisions:

One of the key aspects of making peace with your decisions as a trader is accepting that no decision is perfect. Even the most experienced traders make mistakes, and losses are an inevitable part of trading. This is easier said than done.

When you make a trading decision, you are essentially making a choice based on the information available to you at that moment. This decision-making process is inherently imperfect because it relies on your interpretation of the data and your judgment, both of which can be influenced by a variety of factors.

Having a well laid out trading strategy helps with the decision making process but that does not guarantee a relief from regret. Always remember, trading is a game of probability. All we can do is increase our odds of winning. So, embrace imperfection.

Acknowledging That There Is Nothing Called A Perfect Strategy:

Accepting imperfection in trading involves acknowledging that no trading strategy or decision is 100% accurate. It’s recognizing that there will always be factors beyond your control that can influence the outcome of a trade, no matter how well-researched or thought-out your plan may be. No strategy will ever have a 100% success rate, consistently, over a long period of time.

This acknowledgement is crucial for maintaining a healthy mindset as a trader. It allows you to approach each trade with a level-headed perspective, understanding that losses and unexpected outcomes are part of the trading journey. Instead of beating yourself up over perceived mistakes or missed opportunities, accepting imperfection allows you to focus on learning from each trade and improving your skills over time.

Avoid Pressurizing Yourself Regarding Your Trading Decisions:

In trading, there is often a misconception that success means being right all the time and having a perfect track record. This belief can lead traders to feel immense pressure to always make the right decisions, which can be both unrealistic and detrimental to their trading psychology. For advanced and pro traders- there are no right or wrong decisions. Sometimes they make the right decisions ; sometimes they make the decision right. Until you attain that level of expertise, remember that you do not have to be right all the time. It is okay to make mistakes but try to lose less when you make mistakes so you sustain in the arena longer.

It’s understandable to feel pressured to make the right decisions or predictions, especially with the abundance of videos online where people boast about their successful predictions. If those videos or posts make you feel pressurized, please avoid them. Remember, no one can predict the market correctly 100% of the time. Many of these videos only showcase success stories, but a true thought leader will also share their failures.

It’s important to realize that no single person can move the market. Don’t fall for taglines like “the trader who predicted the fall” or “Is the market following my predictions?”. It may seem impressive until you lose money because of someone’s predictions and they are nowhere to be found. While we can’t stop them from gloating, we can stay centered and focus on our own trading strategies.

Embracing Imperfection:

By embracing imperfection, you can free yourself from the burden of unrealistic expectations and the constant pursuit of perfection. This mindset shift can lead to greater resilience in the face of adversity and a more sustainable approach to trading in the long run.

We’re all unique, and as traders, being independent thinkers is invaluable. Be authentic. Be yourself. Own your decisions.

Practicing Self-Compassion:

Recognize that trading can be mentally challenging. Treat yourself with kindness and understanding, especially when facing losses or setbacks. Remember that no trader is perfect, and it’s okay to make mistakes.

The truth is, trading is inherently uncertain, and no strategy or trader can predict the market with 100% accuracy. Even the most successful traders experience losses and setbacks. What sets them apart is not their ability to be right all the time, but their ability to manage risk effectively and adapt to changing market conditions. So, be kind to yourself. Trading is already a challenging journey; there’s no need to add to the trauma.

A trading journal focused on recording your feelings and emotions will be a great addition if you feel you suffer from trading regrets frequently. Also, I have experienced that writing it down works better than digitally recording information when dealing with emotions.

Moving Forward with Confidence:

Ultimately, making peace with your decisions as a trader is about moving forward with confidence. Trust in your abilities and your decision-making process, and don’t let past mistakes hold you back. By learning from your experiences and staying focused on your goals, you can continue to grow and improve as a trader.

Regretting a trade is wasted energy; use that energy to plan your next move.

Divya Narayanan

Remember that trading is a journey, and every trade, whether successful or unsuccessful, is an opportunity to learn and develop as a trader. By accepting imperfection, learning from your mistakes, and developing a positive mindset, you can move forward with confidence and achieve your trading goals.

Until next time, happy trading and may the markets be kind to you!