The Monthly Time Frame Trading style is advantageous for those with the patience to wait for rewards. It is highly satisfying in terms of peace and profit. Many of us would like to have a relaxed yet efficient trading lifestyle. This timeframe is a suitable one for that purpose. This post will explain how I use the Value Area and Initial Balance concepts to trade the ‘M’ (month) chart. Let us look at an example to understand this concept with ease. In this example, we explore the fight between responsive sellers and initiative buyers. We will discuss examples of the other scenarios too in upcoming posts. For now, let us focus on the following example.

EXAMPLE: NIFTY 50

To trade the Monthly Time Frame, we first need to switch to the ‘M’ option in our Timeframe choice. We will be using the magic of 12 concept to find the value area and Initial Balance for a year. Let us take the Nifty50 index and try to dissect this year’s move so far. By the magic of 12, we will consider each month to be a TPO. Thus, a year will have 12 TPOs( A-L ).

CONTENT

- 1: Analyze the close of 2022

- 2: Marking the value area for this year 2023

- 3. Preparation

- 4: Analyze the open

- 5: Observing candle ‘A’ which is January 2023’s candle.

- 6: Preparing for Entry

- 7. What happened in the ‘B’ candle- February 2023?

- 8. C candle – March 2023

- Conclusion

1: Analyze the close of 2022

The overall close is bullish. December’s closing price is the close price for the year. It is above January’s open price. Thus, the bias given by the closing price is bullish.

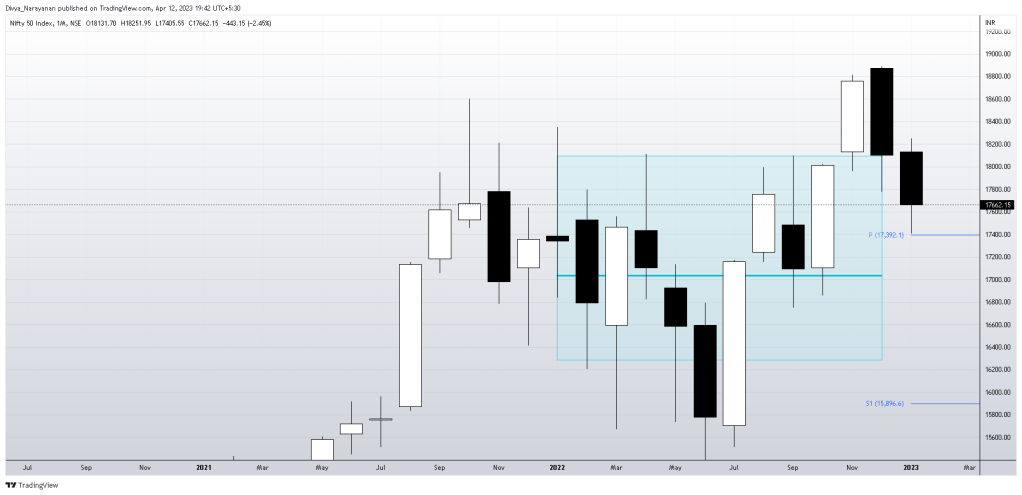

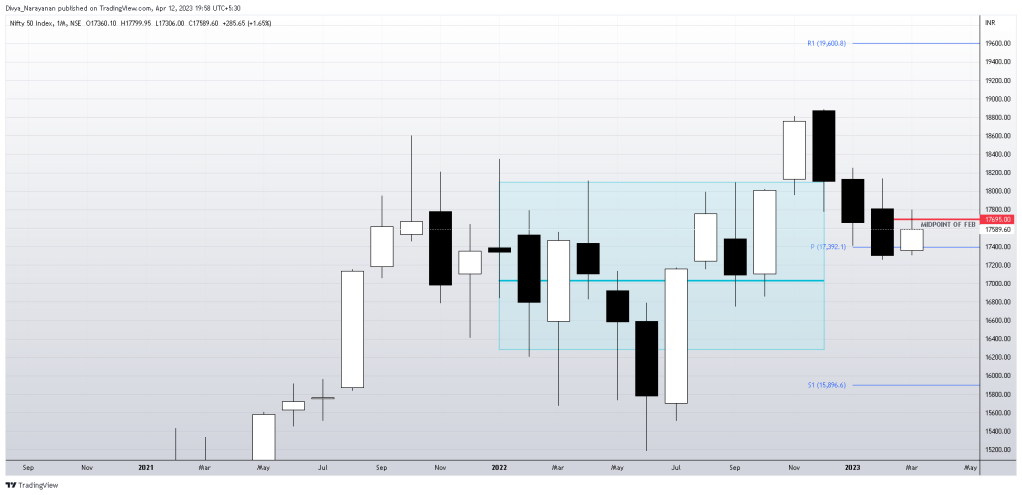

Note: The white candles are bullish candles. The black candles are bearish candles.Monthly Time Frame Chart has one candle for each month’s price action.

Monthly Time Frame Chart of Nifty 50 – year 2022

On a more focused approach, we see that December 2022 was a bearish outside candle( also a bearish engulfing candle that covers the body of the previous candle).

This reversal pattern has occurred at a well-known resistance zone of the month chart. The sellers who sell at resistance zones are responsive sellers. We just need to remember that these responsive sellers may be active in this price zone for the upcoming month(s) too.

2: Marking the value area for this year 2023.

Using the data of the previous 12 months, the value area is calculated to be as follows-

Value Area High (VAH): 18093

Point of Control (POC): 17033

Value Area Low (VAL): 16283

( The value is approximated to avoid decimal digits.)

The Value area bias is bullish. This just means that we look to go long if the opening supports the view.

The Value area formed by the year 2022 becomes the static value area zone for the year 2023.

The value area is marked by the blue box.

3. Preparation:

The close price of the year as well as the value area bias of the year is bullish. So, we should prepare to go long if the opening is suitable.

Knowing that it is quite impossible for the market to open below VAL(16283) we can safely assume that the open will be bullish.

The previous year’s high is 18887.60. It is quite doubtful that the opening of the year will be above the previous year’s high.

So, most probably, the open will be inside value and inside range( neutral bullish) or outside value but inside range( a bit more bullish).

We can prepare to focus on a buy-on-dip scenario.

Zones to go long will be the POC/VAL of the year.

As per the other zones, we can go long at the following zones.

- We have round number supports at 18000 and 17000.

- The classic pivots-based pivot is at 17400 (the exact value is 17392.10)

- The camarilla pivot L3 is at 17087 (the exact value is 17086.65)

The above zones can serve as a place to go long if the price action supports the view.

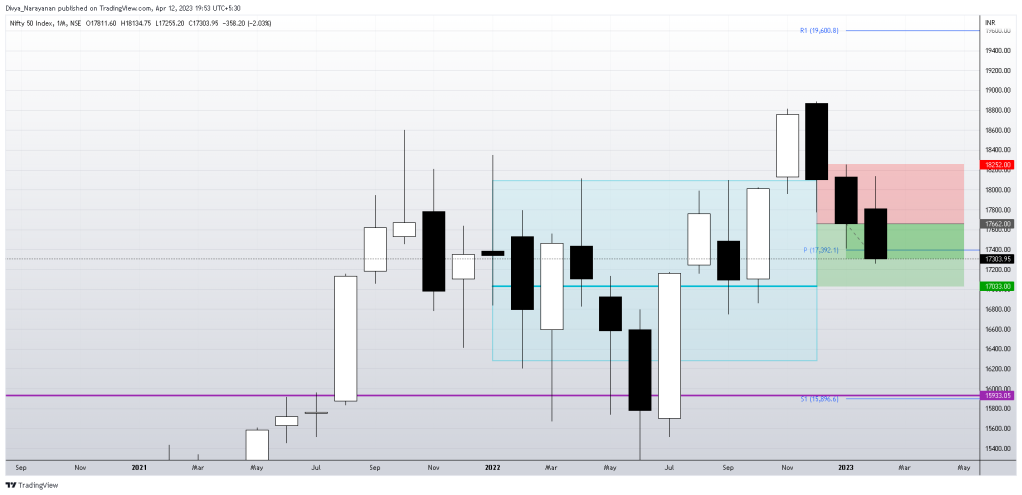

4: Analyze the open

The opening of January is the opening for the year. January 2023 opened at 18131.70 which is a little above the VAH(18093) but below the previous year’s high( 18887.60). We can clearly see that in the image below.

Thus, the open is outside value but inside the range( OV IR Bullish). Whenever the price opens above the value area high it means it is in the expensive zone. So, the participants are Responsive sellers and Initiative buyers.

The buy-on-dip scenario from our preparation still holds.

5: Observing candle ‘A’ which is January 2023’s candle.

An open outside value but inside the range( OV IR) indicates that the participants are Responsive Sellers and Initiative Buyers. We have already marked that responsive sellers were present in the 18000+ price zone. January’s candle fell inside the value area and closed inside it. [ The last candle is Jan 2023 and the blue box is the Value Area]

Now think about who pushed the price down, back into the value. Yes, it is the responsive sellers.

Responsive sellers take the price from the expensive zone to the point of control and further down if the initiative buyers are weak. Once the price is taken below the Value Area Low, responsive buyers will step in. So the primary target for a responsive seller is the fair price( i.e. POC).

Candle A has given us the clue that the price can fall till 17033 which is the POC. Till that target is reached, we can prepare for a sell-on-rise scenario. For February 2023, an entry near the midpoint of January 2023 or even the VAH of the year is possible. The stop loss will be above January’s high(18252). This scenario is only till we reach the POC of the year( Remember the year has a bullish buy-on-dip bias).

6: Preparing for Entry

1. Close price of January 2023 which offers only 1:1 Risk to reward

We can prepare for three different entries

2. The midpoint of January 2023 (17828) which offers a better R:R

3. The VAH retest- which may or may not happen. Offers the best R:R

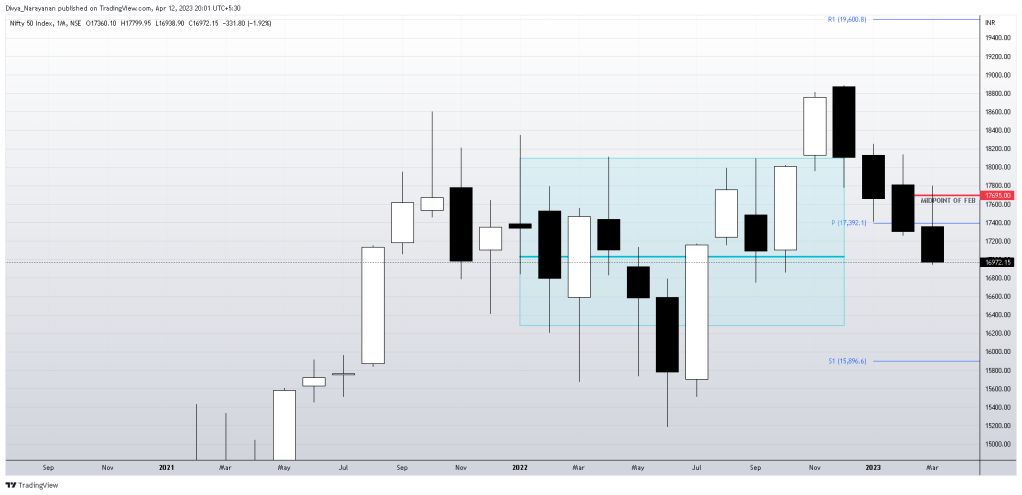

7. What happened in the ‘B’ candle- February 2023?

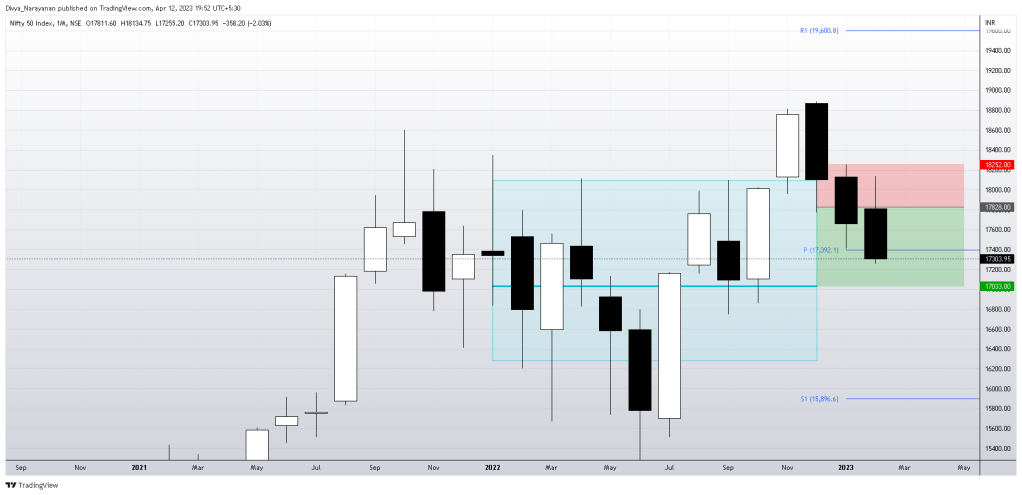

All the three discussed entries were available – close price entry, an entry at the midpoint of January month ( 17828) as well as the entry at VAH of the year( 18093) . Getting either the midpoint or the VAH entry can give us a better risk-to-reward situation than entering at the close. The VAH of the year entry may or may not happen. Luckily, it was touched this time. This entry can serve as an entry with a very small risk.

February 2023 touched both the midpoint of the prior candle as well as the value area high. It ended as a lower high lower low bearish candle. We can continue to hold our shorts for the POC target. Since it is the responsive sellers in play, the price will often keep coming up and be defended at the midpoint zones. Generally, responsive sellers are not as aggressive as initiative sellers. This is why the price keeps coming up.

I have attached three charts one for each entry with the risk:reward marked on it.

First Entry : At the close price of January 2023

Second Entry: Midpoint entry

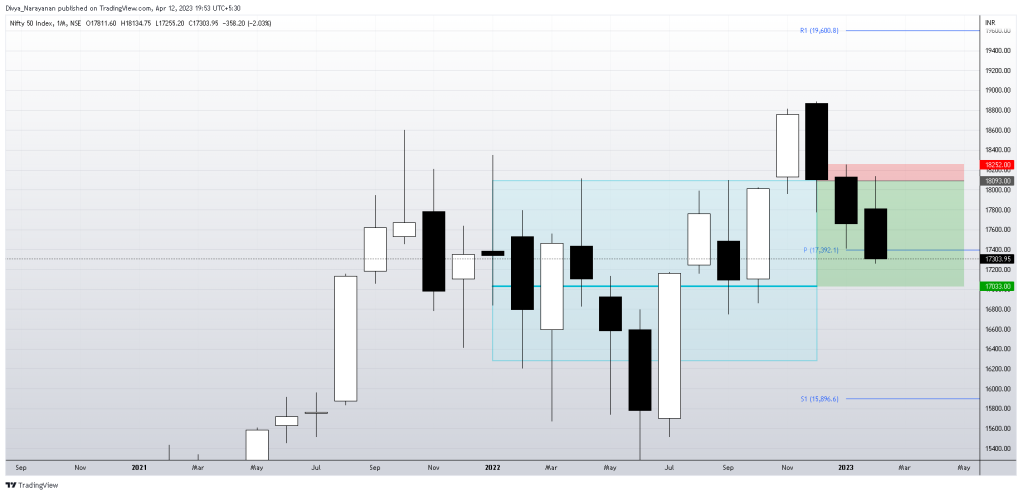

Third Entry : At VAH of year

With shorts in our position, we move into the next month.

8. C candle – March 2023

As discussed earlier, the price may come back up again before going down. So it will be wise to mark the midpoint of February month. It is the zone that we expect the sellers to defend. The midpoint zone is 17695.

We see that ‘C’ comes up and gets defended at the midpoint zone by responsive sellers. We must plan to get out of all or at least most of the lots at POC of the year.

March 2023 candle touched the POC and 17000 zone on Mar 14,2023. Thus one successful trade is done. We should book the shorts here. We should not be greedy and keep holding all the lots. Reason 1 is we have prepared for a buy-on-dip scenario for this year. Reason 2 is this is a responsive seller short.

C candle ( March 2023) stands as an indecision candle or a Doji.

Referring back to our preparation notes, we see that this Doji has occurred in a multiple confluence zone of buy-on-dip. [ 17000 round number + Camarilla L3 17087 + POC 17033]. Also, we know that the first two candles( Jan & Feb) form the initial balance. If that is so, then C (Mar) has become a Range-Extension failure. This is also an entry sign.

This can be a good buying opportunity. We can initiate long trades here.

The usual targets are the Initial Balance High( January’s high), New swing high( 18887.60) & H3 of Camarilla 19125. Since this is a monthly chart-based trade, the targets can be hit sometime before this year ends. So, we need to enter with a farther expiry rather than an April expiry lot.

The stop loss for this trade will be the low of March 2023 at which point it can become a stop and reverse direction kind of trade if price action supports( especially if it happens in the ‘D’ or ‘E’ candle.) In that case, we can see VAL.

Conclusion:

Remember that this is a very high timeframe trading style. The risk and reward- both will be higher compared to a lower timeframe trade.

I hope this has given you a new perspective on how to trade a monthly time frame chart using market profile concepts.

To read more about this concept check here.

Note: Originally published on April 19,2023. Republished due to domain shifting.

Note 2: Credit: Charts by Trading View

To know what happened in the upcoming months check here( link coming soon).